can you look up a tax exempt certificate

Please note it may take up to 2 business days for your status to be approved or denied. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

Tax Exempt Meaning Examples Organizations How It Works

Next the individual proceeds to select the Tax Exempt Organization Search Tool which is shown below.

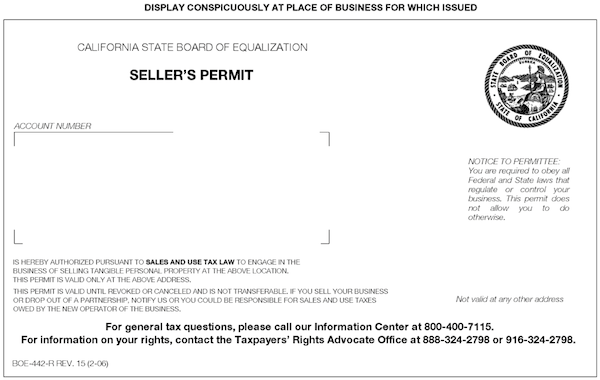

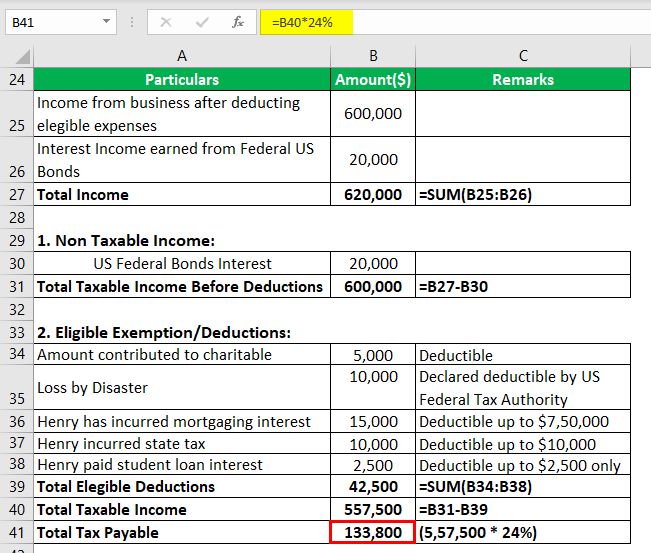

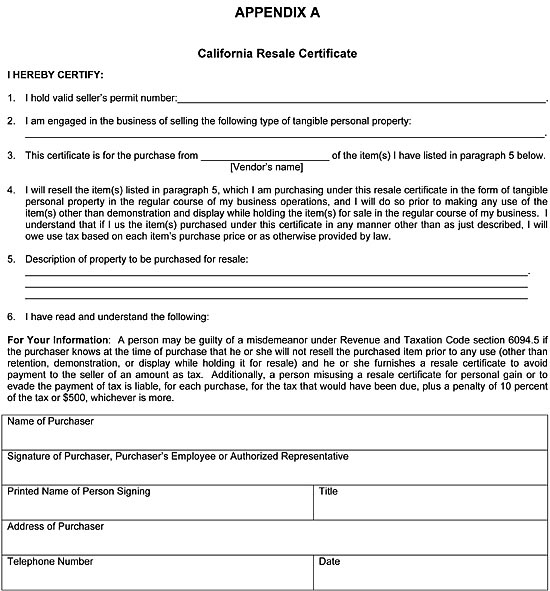

. To get started click on the Verify a Permit License or Account Now. Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purpose of the business must be expressed in full detail.

Sales tax exemption certificates may also be issued and accepted electronically in York and. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. You can verify that the organization is a tax exempt non-profit organization.

Automatic Revocation of Exemption List. Here are several steps a company should take to validate a certificate. While requirements vary by state and purpose most resale and tax certificates require certain information to be.

The Department of Revenue recently redesigned the certificates the Department issues. An EIN or Employee Identification Number must be obtained. Form 990-N e-Postcard Pub.

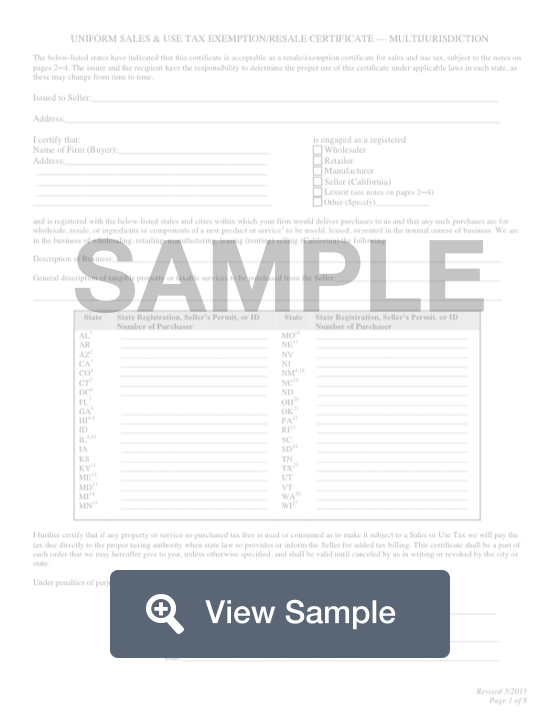

To apply for tax-exempt status the following must happen. This multijurisdiction form has been updated as of February 4 2022. You may also contact the Internal Revenue Service at 877829-5500 and ask that they verify the.

If a seller accepts an unsigned and undated certificate the liability for the sales tax will likely be on the seller. The online search tool allows you to search for an organizations tax exempt status and filings in the following data bases. The purchaser fills out the certificate and gives it to the seller.

The tool will output the status of the resale certificate within a few seconds. In some cases you must also have a valid Certificate of Authority to use an exemption certificate. On the next page use the dropdown menu to select Sellers permit.

From there click the Start Over button Business Verify an Exemption Certificate. About the Tax Exempt Organization Search Tool. The Certificate itself contains instructions on its use lists the States that have indicated to the Commission that a properly filled.

All information on the certificate is completed. Arkansas Use either the resellers permit ID number or Streamlined Sales Tax number. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases that remain taxable and how to effectively administer these tax provisions. If approved you will be eligible to make tax-exempt purchases immediately. The name of the buyer matches your customer name.

Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each. Form 990-N e-Postcard Pub. This is a mandatory step regardless of whether the entity has employees or not.

Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax. If you fail to verify all necessary data pertaining to your circumstances an auditor may deem your resale or tax exemption certificate invalid which in return can lead to back taxes and penalties. Payment for the purchase must be made with the governmental entitys funds.

California Enter available information for verification. The Challenges of Verification. Choose Search and you will be brought to a list of organizations.

The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. Look for a line that says Streamlined Application for Recognition of Exemption Under. Automatic Revocation of Exemption List.

Additional Information for new users. Although you cannot search by tax exempt number you can search by the organization and location. Up to 7 cash back To check the status of your application click on Tax-Exempt Program and then click Tax-Exempt Application.

Exemptions Certificates and Credits. You can then enter the permit Identification Number you want to verify and click the Search button. Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries.

The online search tool is then selected which finally. The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate. Complete the Type of Business Section.

Arizona Enter the number here. Different purchasers may be granted exemptions under a states statutes. When payment is made with the personal funds of an authorized representative the purchase is subject to tax even if the representative is subsequently.

There are a number of. Form 990 Series Returns. Number should have 8 digits.

A copy of the articles of incorporation must be submitted. You can also search for information about an organizations tax-exempt status and filings. Buyers can click here Form 1746 to apply for an exemption certificate and must provide a completed Form 149 Sales and Use Tax Exemption Certificate to the seller.

Provide a copy of the Florida Consumers Certificate of Exemption to the selling dealer to make tax exempt purchases or leases in Florida. Colorado Enter the 7 8 11 or 12-digit. Your status will show.

The form is dated and signed. There are different types of exempt. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase.

Proceeding to the next page an individual can then select the Search or Charities option which is amongst the options on the left-hand side of the page as shown below. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses. Buyers may also be able to use the Uniform Sales and Use Tax Exemption Resale Certificate see page 2 or contact the states revenue department for state-specific information.

Form 990 Series Returns. In Progress or Accepted or Rejected. Exemptions are based on the customer making the purchase and always require documentation.

The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. In order to access a copy of your original 1023 EZ form you will need to log in to your account click on My Account in the upper right-hand corner of the screen and then click on My Forms This page will list any forms submitted through your account.

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Printable California Sales Tax Exemption Certificates

Resale Certificate How To Verify Taxjar

Free 10 Sample Tax Exemption Forms In Pdf

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Free 10 Sample Tax Exemption Forms In Pdf

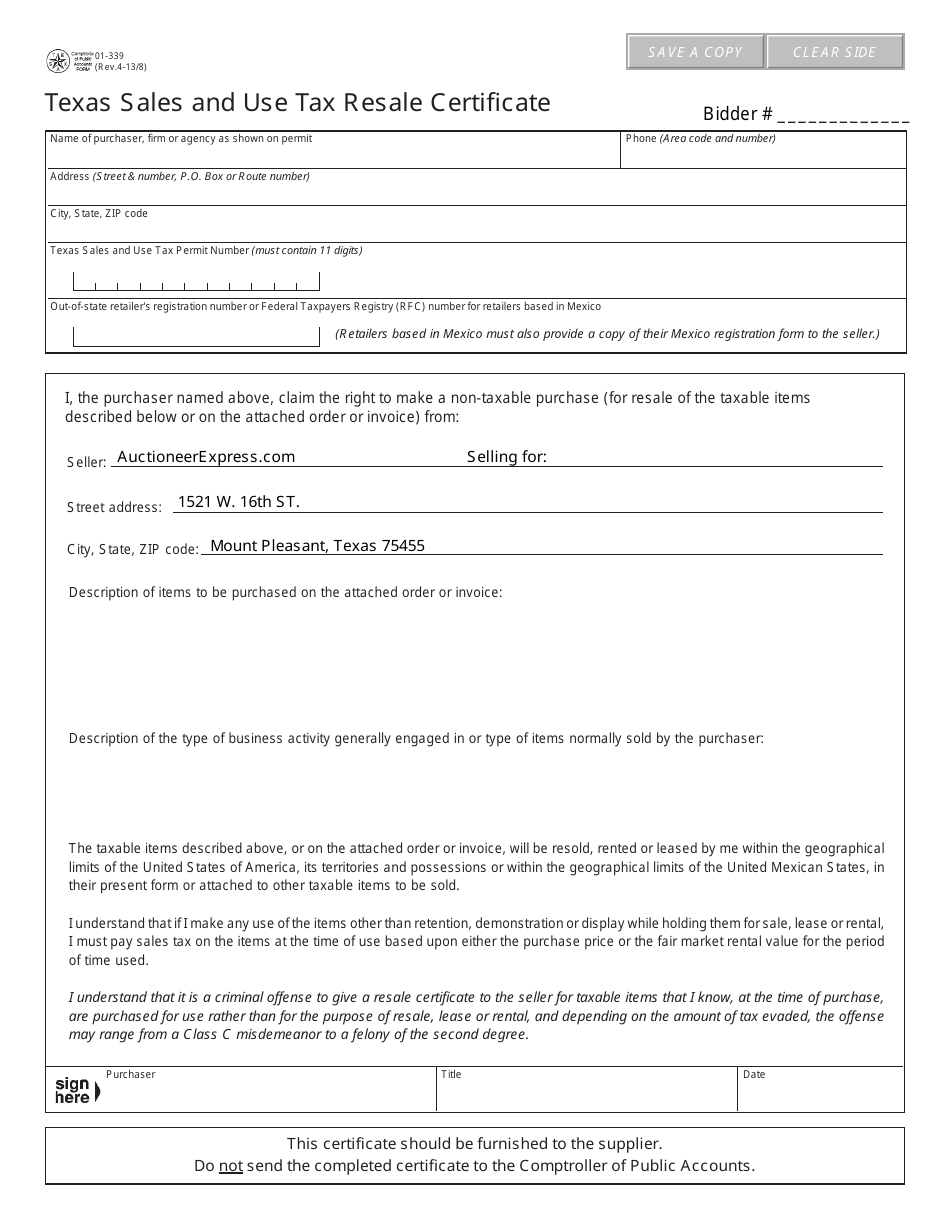

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

How To Get A Certificate Of Tax Exemption In The Philippines Filipiknow

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf